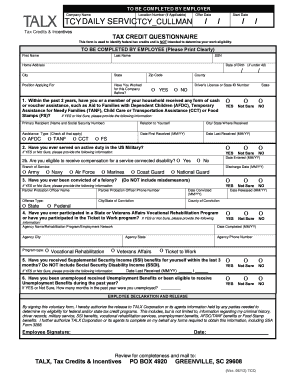

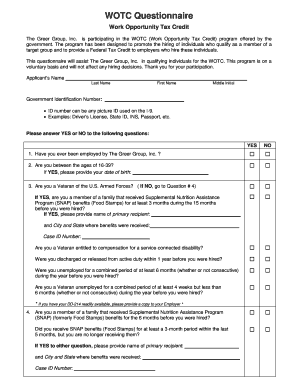

work opportunity tax credit questionnaire form

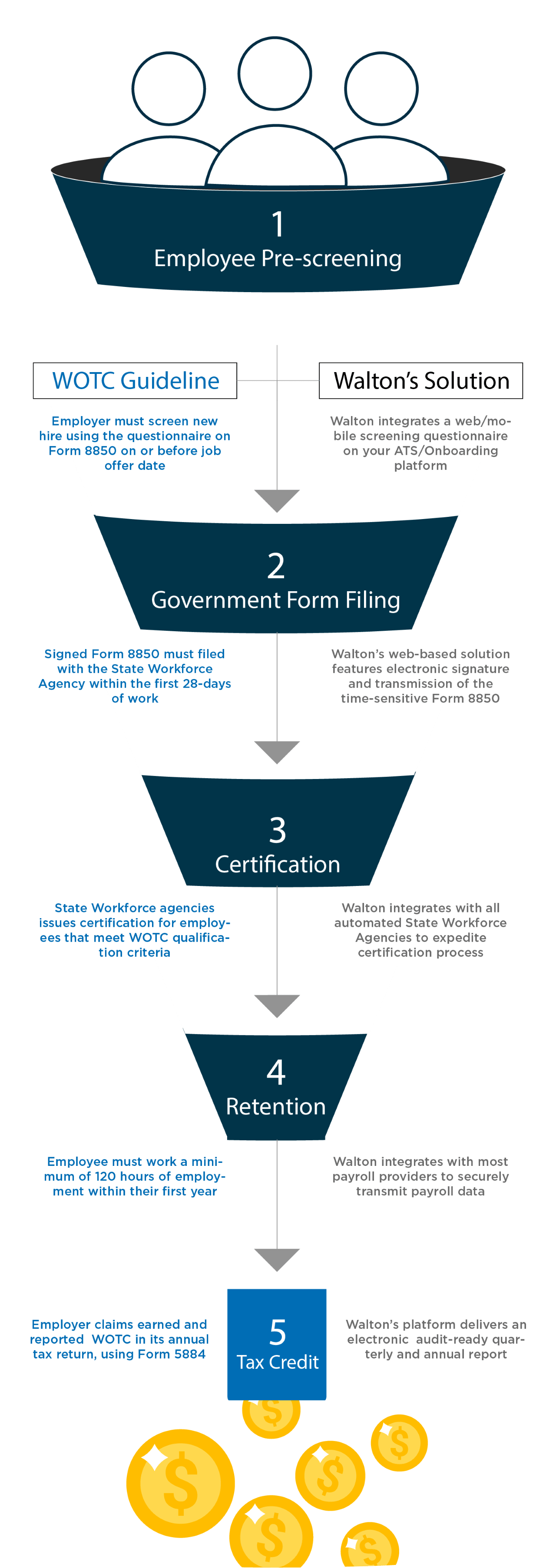

The answers are not supposed to give preference to applicants. Employers use Form 8850 to pre-screen and to make a written request to their state workforce agency SWA to certify an individual as a member of a targeted group for purposes of qualifying for the work opportunity credit.

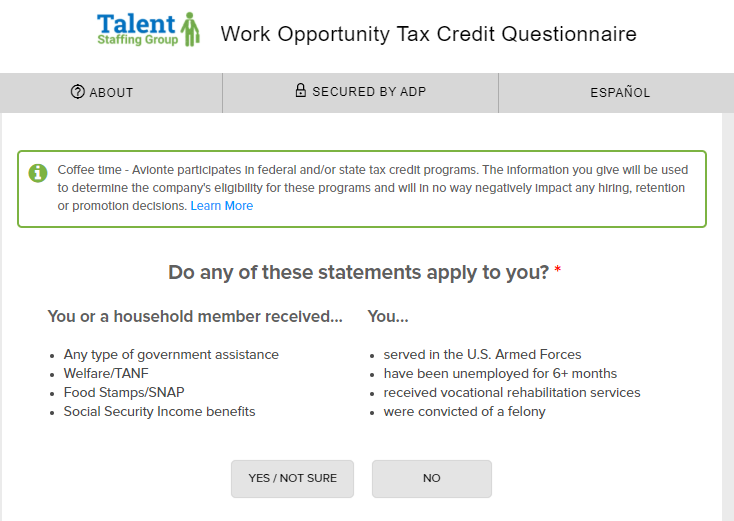

WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers.

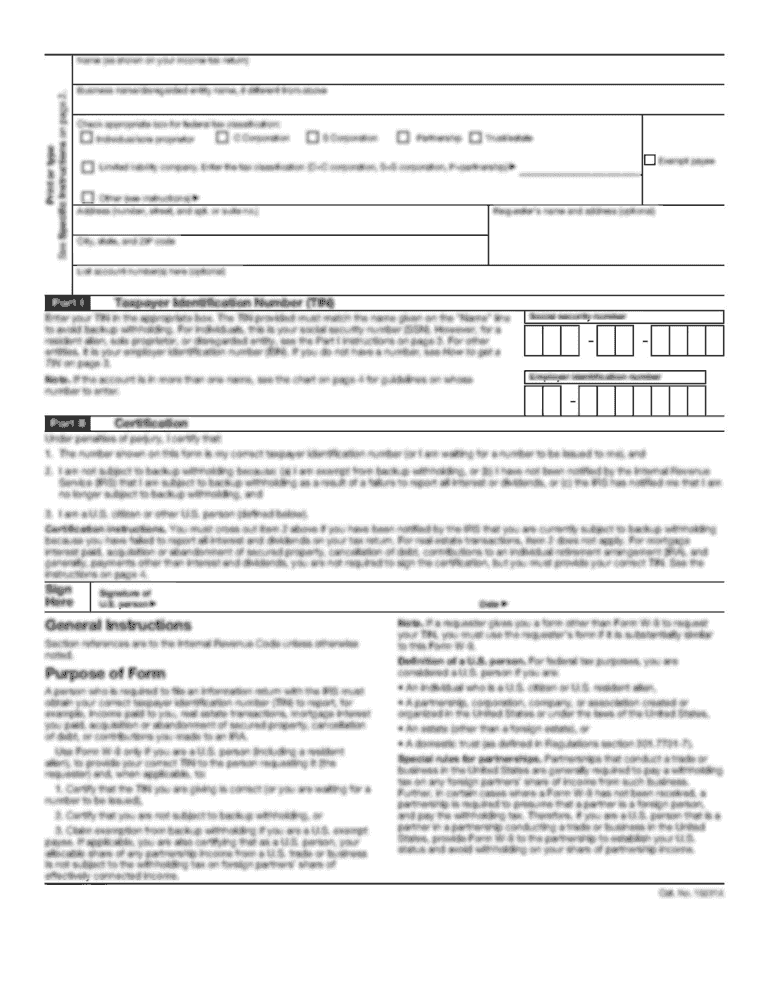

. This is so your employer can take the Work Opportunity Tax Credit. To claim the tax credit when filing your federal business tax return use IRS form 5884. Employers use Form 8850 to make a written request to their SWA to certify someone for the work opportunity credit.

Your name Social security number a. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training Administration Form 9061 and ETA Form 9062. Below you will find the steps to complete the WOTC both ways.

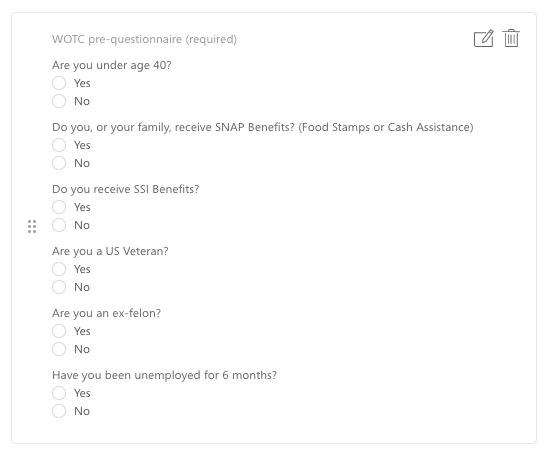

Get access to thousands of forms. Enter all necessary information in the required fillable areas. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions.

The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. We need your help. Now creating a Wotc Questionnaire requires at most 5 minutes.

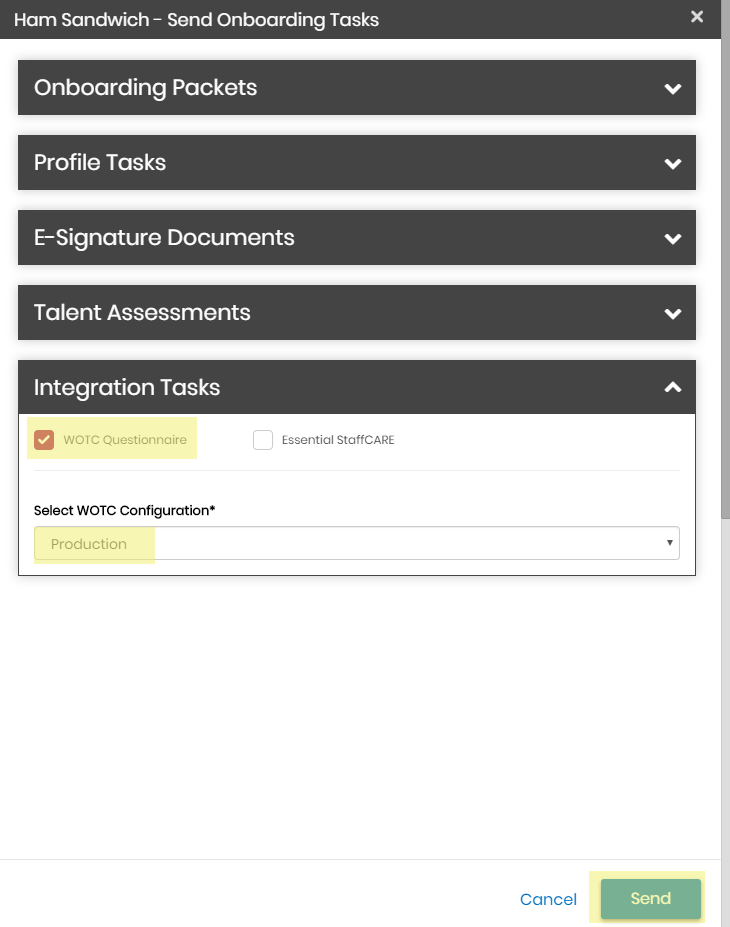

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Ad Download Or Email Talx Tax Credit More Fillable Forms Register and Subscribe Now. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Pick the template in the library. Use professional pre-built templates to fill in and sign documents online faster. New hires may be asked to complete the WOTC questionnaire as part of their onboarding paperwork or even as part of the employment application in some cases.

Page one of Form 8850 is the WOTC questionnaire. Completing Your WOTC Questionnaire. The information will be used by.

ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form. 501c tax exempt organizations use IRS form 5884-C. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc.

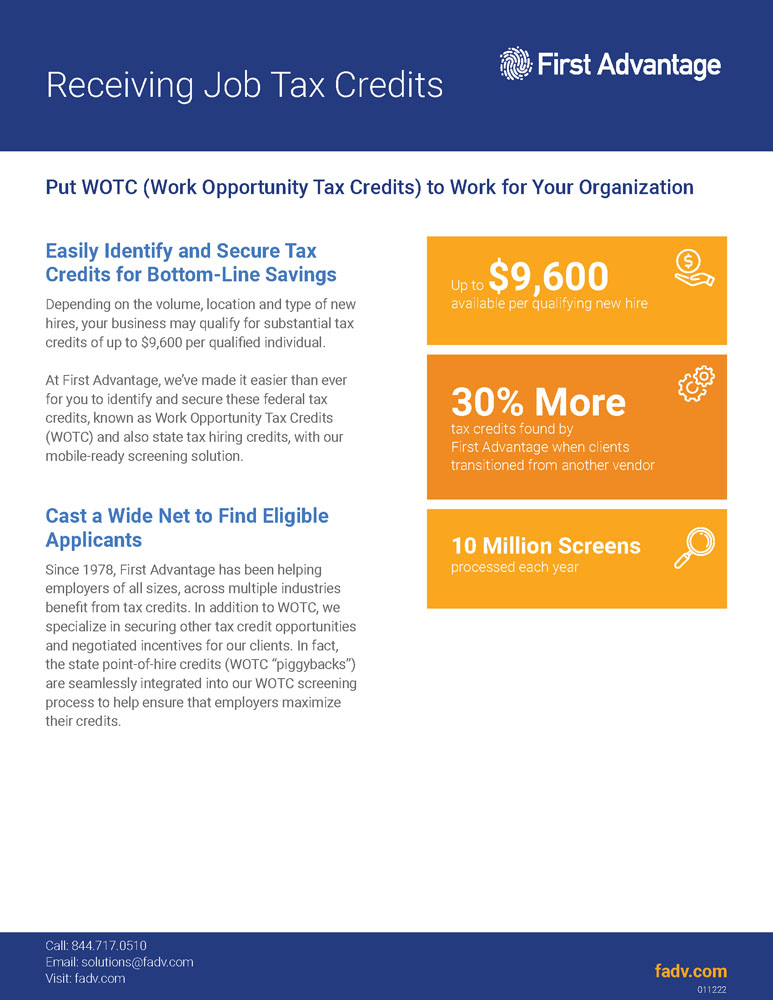

It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Is participating in the WOTC program offered by the government. The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine.

Complete only this side. Work Opportunity Tax Credit questionnaire. Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program.

What is the Work Opportunity Tax Credit. Qualifying Groups For the employer to claim the WOTC for a new hire the employee must be certified as a member of a targeted group by meeting the criteria described in any of the groups listed below. Comply with our simple steps to have your Wotc Questionnaire well prepared quickly.

January 2012 Department of the Treasury Internal Revenue Service Pre-Screening Notice and Certification Request for the Work Opportunity Credit a See separate instructions. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. The form may be completed on behalf of the applicant by. They are allowed to ask you to fill out these forms.

Fill in the lines below and check any boxes that apply. Get and Sign Wotc Questionnaire 2012-2022 Form Use a wotc form 2012 template to make your document workflow more streamlined. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

Employers must apply for and receive a certification verifying the new hire is a. If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

13 permits a prospective employer to request the applicant to complete WOTC Form 8850 and give it to the prospective employer. IRS Form 5884 Work Opportunity Tax Credit Use form to report Work Opportunity Tax Credit with tax return. Completing Your WOTC Questionnaire.

The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. Our state online blanks and complete recommendations eliminate human-prone mistakes. The WOTC program not only creates a positive impact on the nations unemployment levels but also affords business owners the incredible opportunity to earn between 2400 and 9600 for each eligible new hire.

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and state tax credit programs. IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax Credit.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Form TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now. Please complete the attached form by following the instructions provided.

Work opportunity tax credit 2020. IRS Form 8850 Instructions Instructions for completing IRS Form 8850. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers rewarding them for every new hire who meets eligibility requirements.

1 the employer or employer representative the SWA a participating agency or 2 the applicant directly if a minor the parent or guardian must signtheform andsignedBox 25aby theindividual completingthe. Below you will find the steps to complete the WOTC both ways. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group.

Create this form in 5 minutes.

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Completing Your Wotc Questionnaire

Work Opportunity Tax Credit What Is Wotc Adp

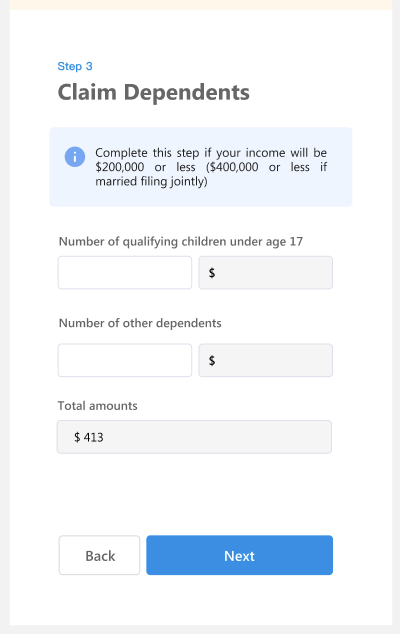

New W4 Form Wotc Screening Features Product Updates

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Get And Sign Wotc Questionnaire 2012 2022 Form

Work Opportunity Tax Credit First Advantage

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credits Wotc Walton

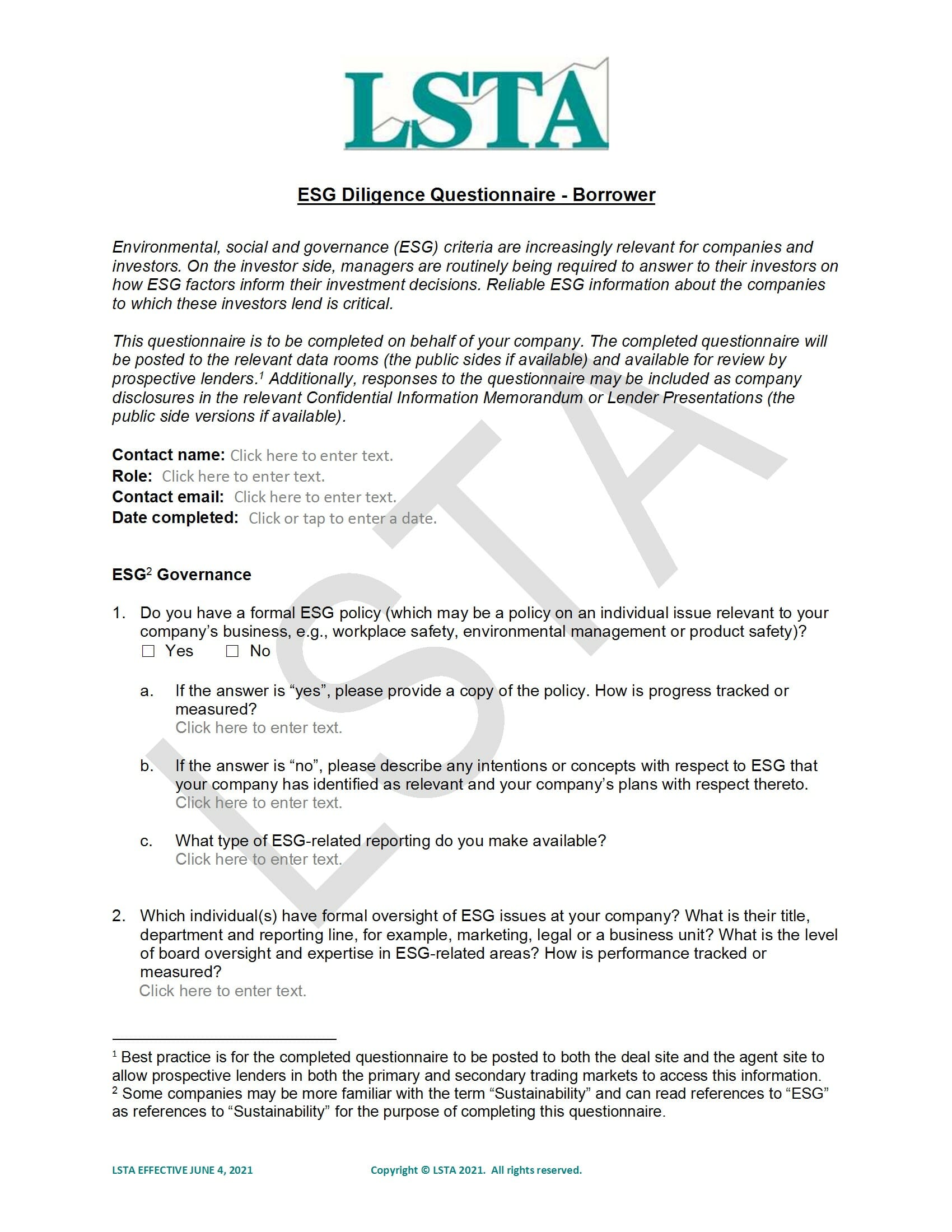

Esg Diligence Questionnaire Borrower Lsta

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

New W4 Form Wotc Screening Features Product Updates

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit What Is Wotc Adp